Our team can create your company in minutes and have all the documents delivered to your inbox in hours, not weeks. Not only do we provide company and ACN setup, we complete all other relevant setup such as your Australian Business Number (ABN), Tax File Number (TFN) and register your business for Pay As You Go (PAYG).

Getting your business structure set up right the first time will ensure that you don't unnecessarily waste time and money on establishing a structure that is not right for you and will minimise the risk of unintended consequences (including tax consequences).

Create Your Business make it easy to setup your business structure. We include:

- Company Setup

- ABN Registration

- TFN Registration

- PAYG Registration (if required)

- Business Name Registration (if your trading name is different to your company name).

There are a number of business structures, with popular ones being:

Company: As a separate legal entity, a company must register with the Australian Securities and Investments Commission as a separate legal entity (ASIC). A company is entitled to the same rights as a natural person. This implies that it is capable of performing all actions that a real person is capable of, including making agreements and taking on debt. It is also capable of suing and being sued. Shareholders are the owners of a company (sometimes referred to as members). These shareholders may consist of trustees, other corporations, or natural beings. In general, shareholders are not accountable for the debts of the firm and can restrict their personal liability to the value of their shares (unless they provide personal guarantees to borrow money).

Sole Trader: A sole trader is the simplest business structure. It involves a natural person being responsible for all aspects of the business. For example, the sole trader can, in their own name, enter into contracts and incur debt. Because of this, there are no limits on a sole trader’s personal liability to their business – and the sole trader may sue, and be sued, in their own name. A sole trader does not need to register their business with ASIC unless they are conducting business under a name other than their personal name.

Partnership: A partnership is made up of two or more individuals or organisations that conduct business together or share profits. Control or management of the company is shared by the partners in a partnership. A partnership isn't a distinct legal person. As a result, each partner will be responsible for the partnership's and its company's debts and liabilities. A partnership agreement is frequently entered into to regulate the formal parameters of a partnership, such as decision-making and transfers or sales of a partnership interest. For administrative ease, the partners may also choose a manager who will serve as the partnership's manager, as the title suggests.

Trustee of a Trust: In a trust, the trustee (who may be a natural person or a business) agrees to hold onto property or assets (such as financial assets) for the benefit of others (known as beneficiaries). Although the trust (on whose behalf the trustee is operating) will hold the beneficial ownership, the trustee will be the actual owner of the property or assets. As a result, the trustee will have to sign agreements, take on debt, and other things on the trust's behalf. A formal deed must be signed to create a trust, between the trustee, the settlor, and the appointees (if applicable).

A 'Pty Ltd' company is a business structure that has at least one shareholder and no more than 50 non-employee shareholders. The liability of shareholders in a 'Pty Ltd' company is limited to the value of their shares.

A 'Pty Ltd' is a private company.

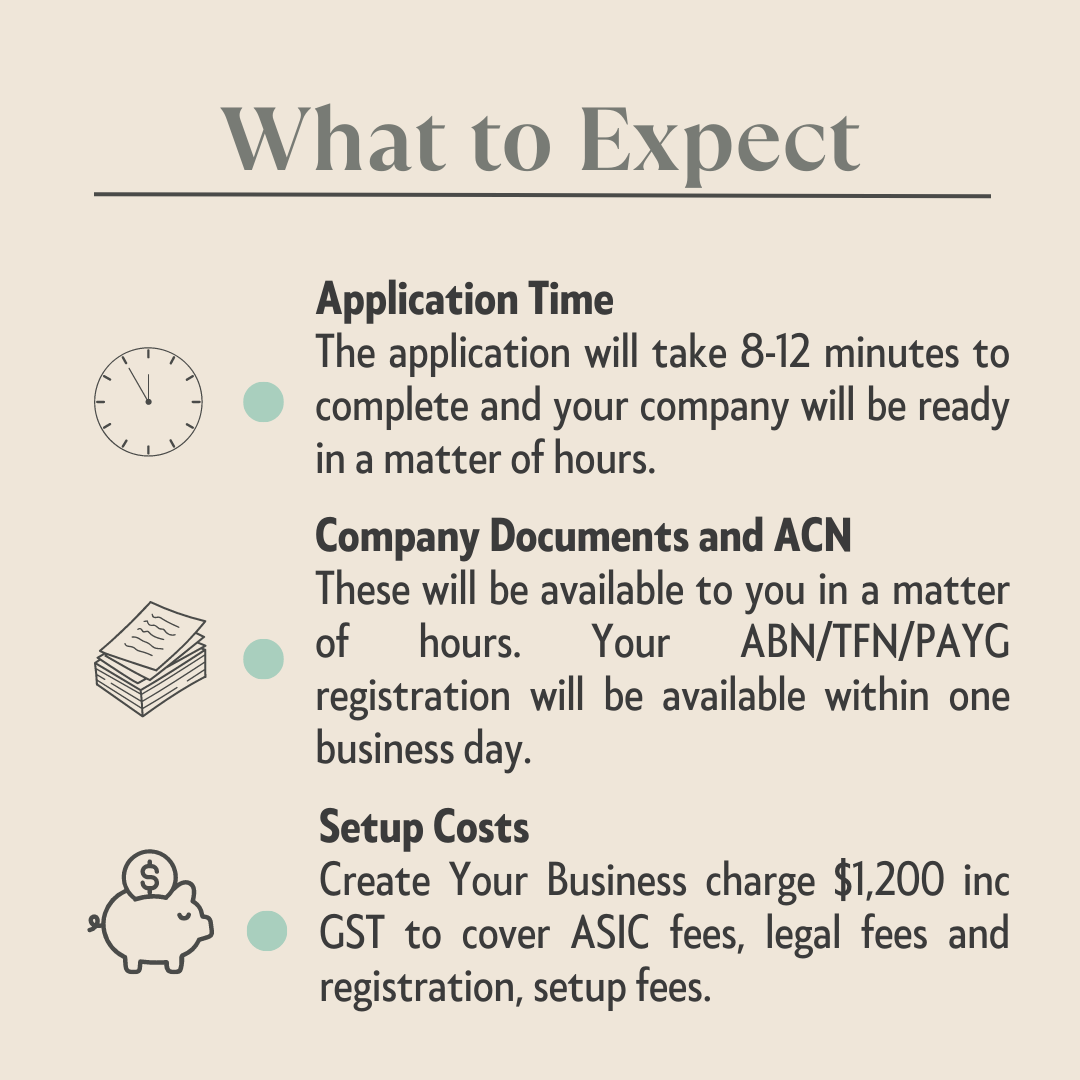

The cost for Create Your Business to register your company is $1,200 inc GST and this includes the company registration fees with ASIC, registration fees for ABN, TFN and/or PAYG as well as any legal fees.

You will receive standard business documents that include the company resolution and ACN registration. You will also receive documents required for ABN / TFN / GST / business name registrations, and a minutes template for the allotment of shares.

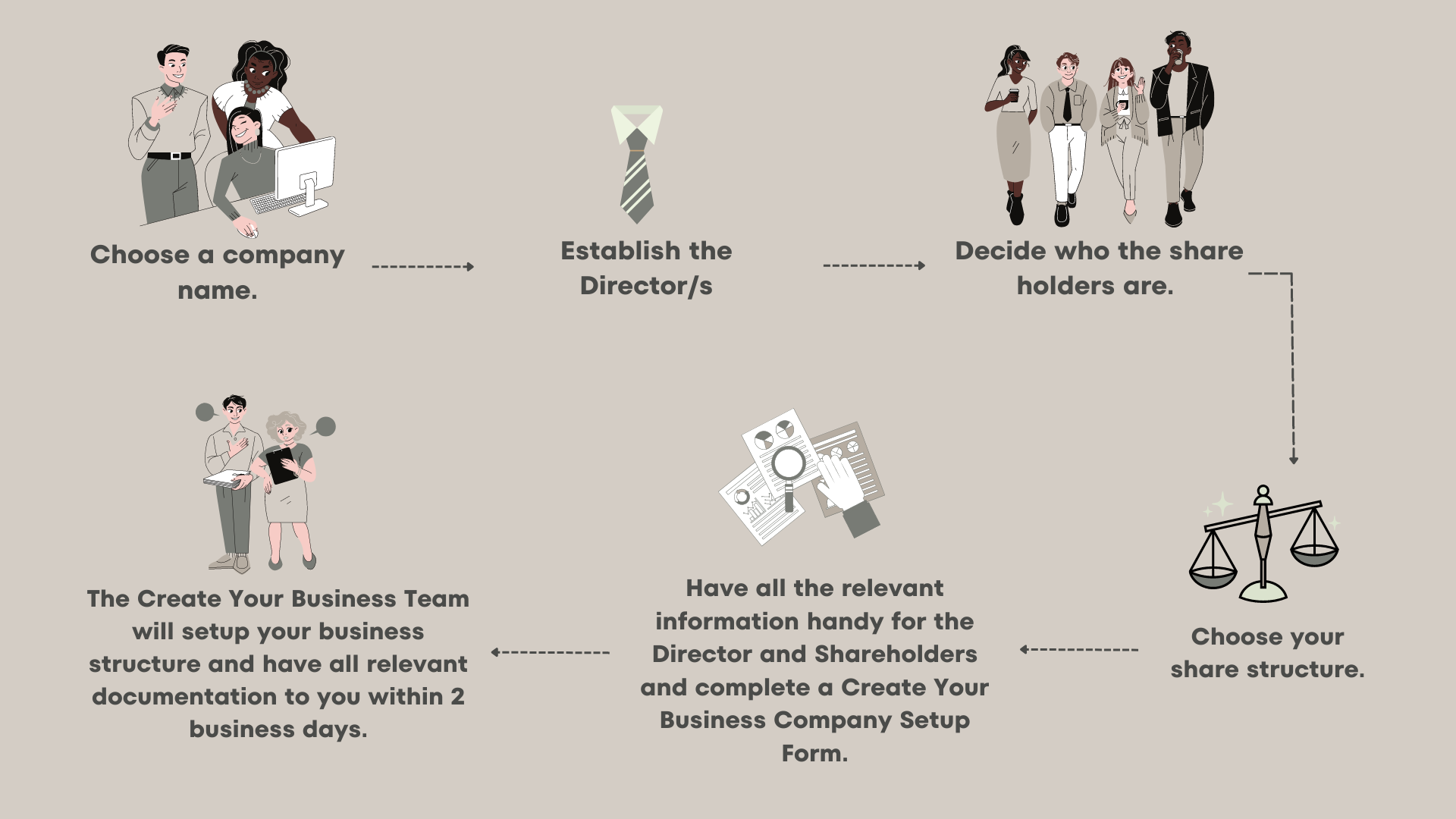

It will take you approximately 8-12 minutes to complete the questionnaire required to register a company. Create Your Business will then issues your ACN documents within a few hours of receiving your application (within business hours) and all other documentation within 2 business days.

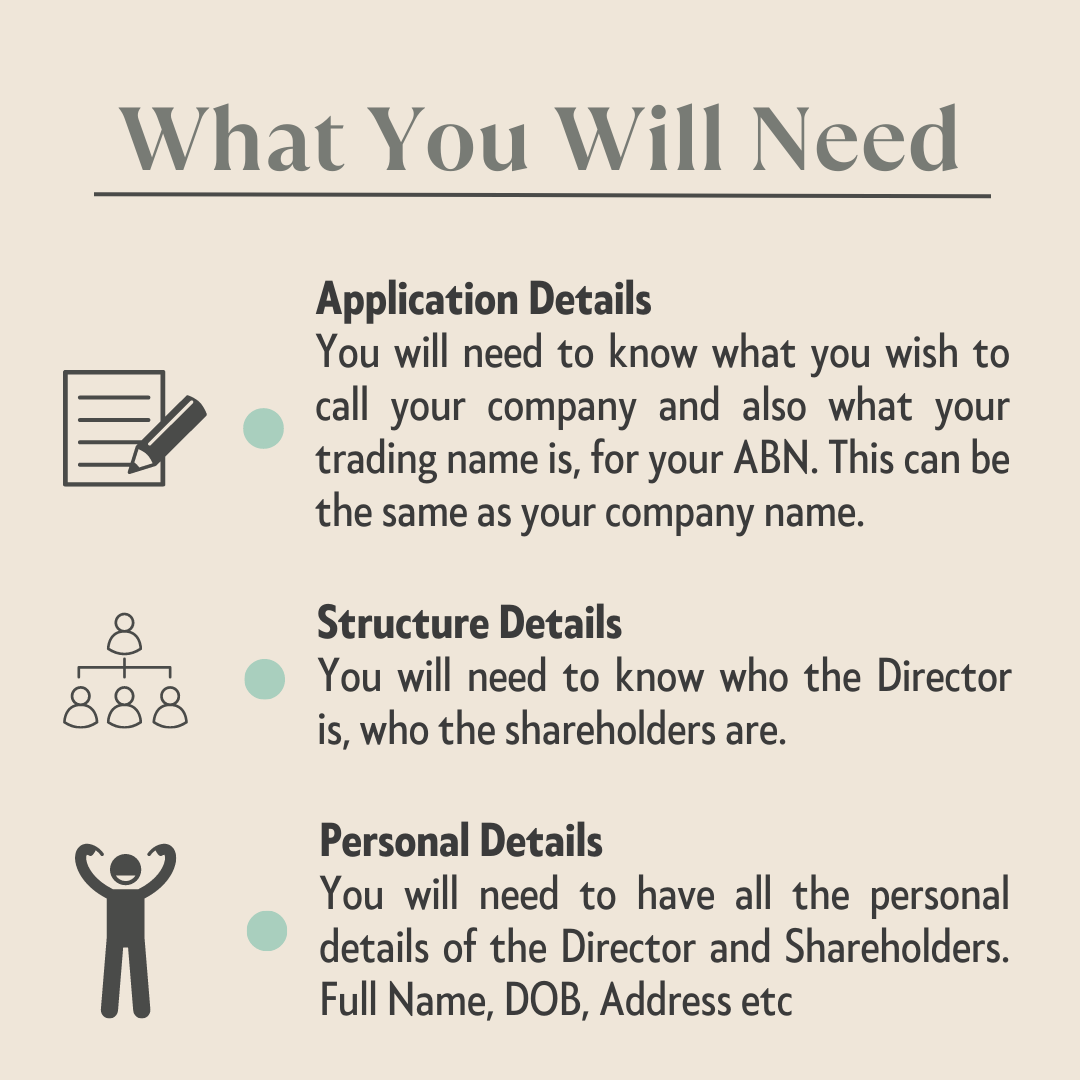

You will need to have the following information handy when setting up a company:

- The name you wish to call your company.

- Registered office address.

- Principles place of business address.

- Company officer holder details. This includes director(s), public officer, company secretary (optional) - including full name, any former names, residential address, date of birth, place of birth, appointment date and director identification number (for directors).

- Shareholder details, including full name, ACN, address and trust details (as applicable).

- Number and type of shares to be issued to each shareholder; and jurisdiction of the company (for example, will it be registered in Queensland?). Don’t stress if you don’t have these details. Simply send us and email and we can work through this with you info@createyourbusiness.com.au

An ACN is a 9 digit number allocated by the Australian Securities and Investments Commission (ASIC) when a body becomes registered as a company under the Corporations Act.

ASIC is the 'Australian Securities and Investments Commission'. ASIC is an independent Australian government body. It is set up under, and administers, the Australian Securities and Investments Commission Act 2001. ASIC carries out most of its work under the Corporations Act.

An 'Australian Business Number' (ABN) is a unique 11 digit number that identifies your business or organisation to the government and community. It is issued to all entities registered in the Australian Business Register.

It is compulsory for businesses with a GST turnover of $75,000 or more to have an ABN and be registered for GST. If a business has a GST turnover of less than $75,000, the business can still apply for an ABN and may choose to register for GST once they have an ABN. You should speak with your account regarding the need for you to apply for an ABN (and register for GST).

An ABN is a business number that can be issued to all entities including sole traders, partnerships and companies. An ABN is issued by the Australian Tax Office (ATO). In contrast, an ACN is only issued to companies. An ACN is issued by ASIC.

Generally, you will need to register a business name if you carry on business within Australia.

However, there are exceptions to this - including, if you are an already registered Australian company and your operating name is the same as your company name.

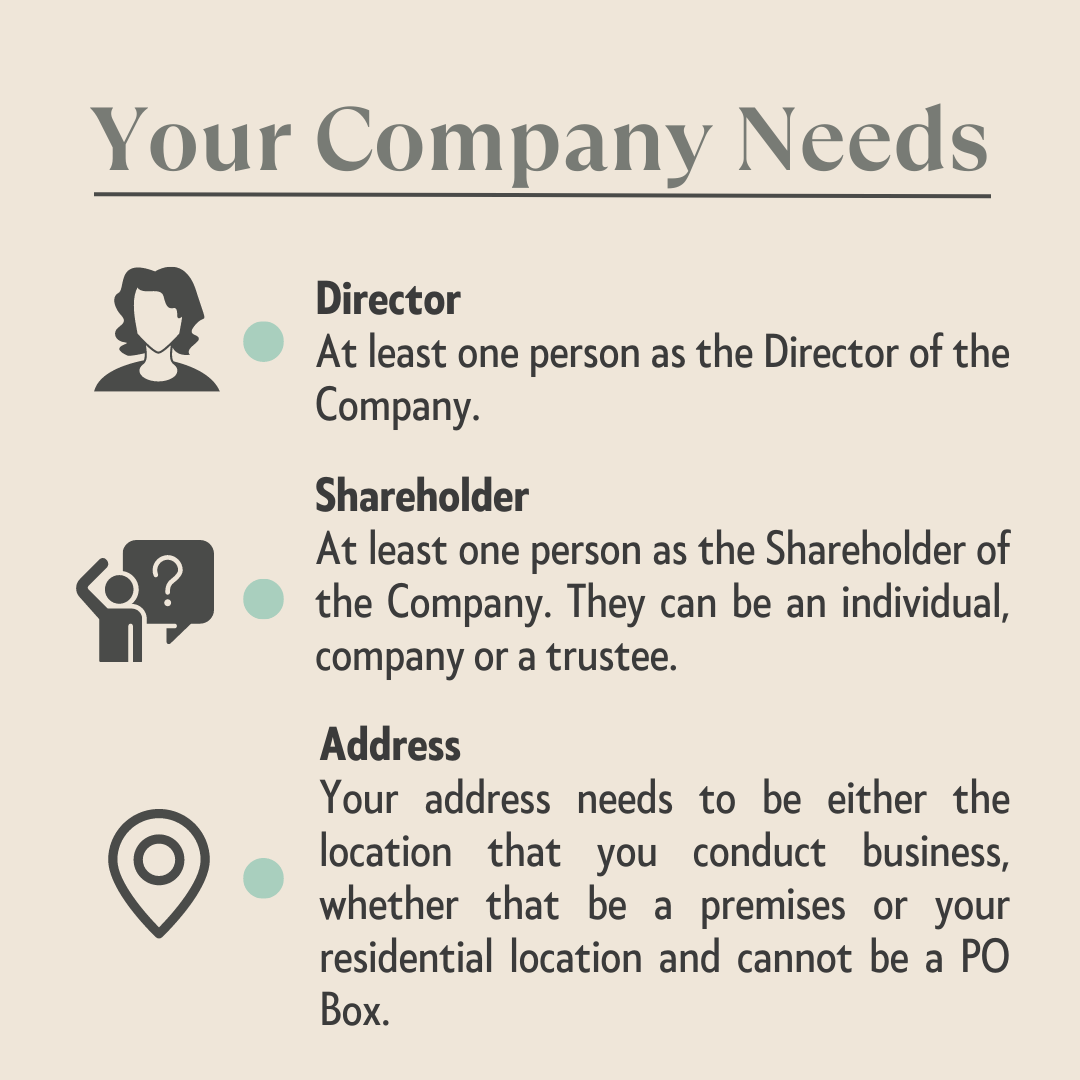

The registered office is where correspondence relating to the company will be delivered to the company. The principal place of address is where the business primarily undertakes its business. Your company will need a registered office address and principal place of business address because ASIC requires that information. A registered office and principal place of business can be at the same address.

If your registered office or principal place of business address is your residential address, you may use that address. It is worth noting that the addresses used will be shown on a company search for your company - and anyone may conduct a company search of your company.

Your company must have at least one director. Your company does not need a company secretary.

The share structure is up to you. You can issue the number and type of shares that suits your purposes. If you are unsure of your share structure, get in touch with us for assistance.

A company must not have more than 50 non-employee shareholders. There is no restriction on the number of shares that may be issued. However, it may be a good idea to issue 100 shares when we register your company. This usually makes it easier to transfer shares to new or existing shareholders without having to continually alter the company's share capital.

Yes you can. You can have Create Your Business make these changes, or your accountant.

Generally, you must register for GST when your business has a GST turnover (gross income from all businesses minus GST) of $75,000 or more. If you choose to register for GST, generally you must stay registered for at least 12 months.

If you don't register for GST and are required to, you may have to pay GST on sales made since the date you were required to register. This could happen even if you didn't include GST in the price of those sales. You may also have to pay penalties and interest.